COMPANIES THAT ARE REQUIRED TO REPORT

ARE CALLED REPORTING COMPANIES

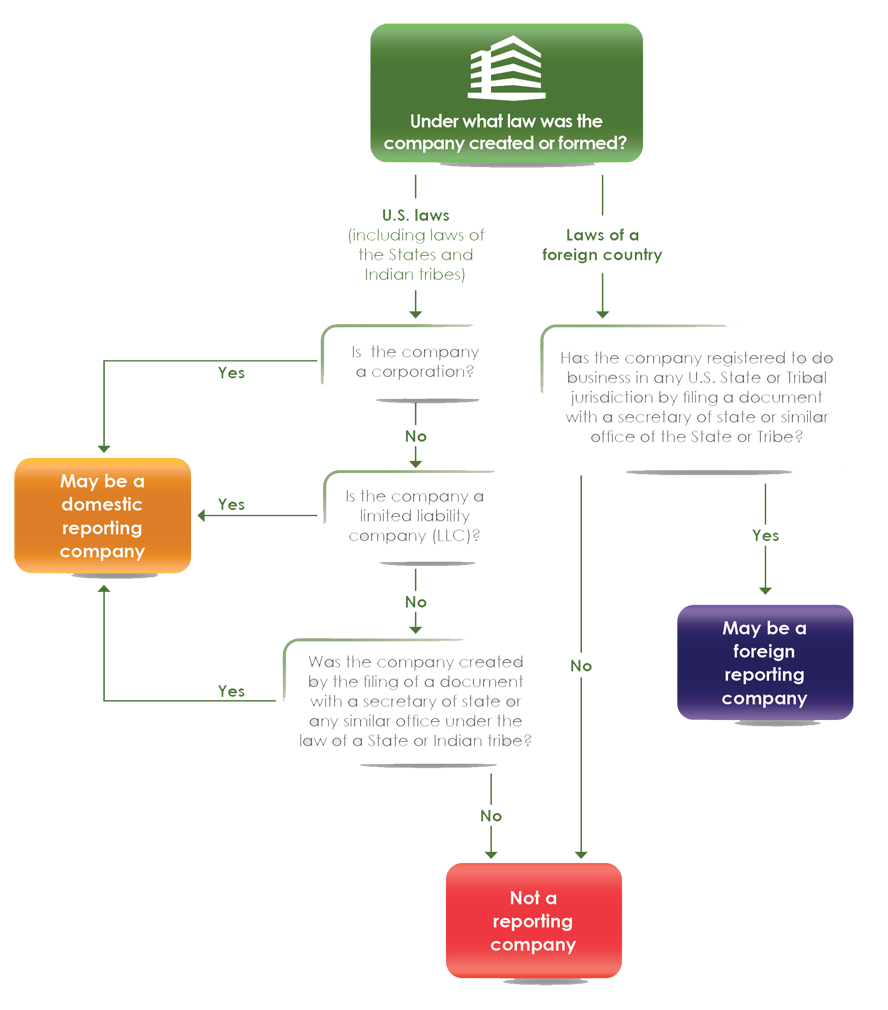

There are 2 types of reporting companies:

DOMESTIC REPORTING COMPANIES are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

FOREIGN REPORTING COMPANIES are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

HERE'S A USEFUL CHART TO HELP FIGURE THIS OUT

..... BUT BE SURE TO KEEP READING BELOW FOR MORE INFO .....

Are any companies exempt from these reporting requirements?

There are 23 types of entities that are exempt from the reporting requirements. Carefully review the qualifying criteria before concluding that your company is exempt. (This can be tricky area for some companies, as it may not be 100% clear that they are exempt. In those situations, we recommend you file anyway, as a precaution. REMEMBER - You can't get in trouble for filing if you weren't required, BUT you can get into massive trouble if you don't file when you were required to)

What entities are exempt from the reporting requirements?

- 1. Securities reporting issuer

2. Governmental authority

3. Bank

4. Credit union

5. Depository institution holding company

6. Money services business

7. Broker or dealer in securities

8. Securities exchange or clearing agency

9. Other Exchange Act registered entity

10. Investment company or investment adviser

11. Venture capital fund adviser

12. Insurance company

13. State-licensed insurance producer

14. Commodity Exchange Act registered entity

15. Accounting firm (only large ones that are already registered under Sarbanes-Oxley)

16. Public utility

17. Financial market utility

18. Pooled investment vehicle

19. Tax-exempt entity

20. Entity assisting a tax-exempt entity

21. Large operating company

22. Subsidiary of certain exempt entities

23. Inactive entity

Is a sole proprietorship a reporting company?

No, unless a sole proprietorship was created (or, if a foreign sole proprietorship, registered to do business) in the United States by filing a document with a secretary

of state or similar office.

Are certain corporate entities, such as statutory trusts, business trusts, or

foundations, reporting companies?

It depends. A domestic entity such as a statutory trust, business trust, or foundation is a reporting company only if it was created by the filing of a document with a secretary of state or similar office. Likewise, a foreign entity is a reporting company only if it filed a document with a secretary of state or a similar office to register to do business in the United States.

State laws vary on whether certain entity types, such as trusts, require the filing of a document with the secretary of state or similar office to be created or registered.

Is a trust considered a reporting company if it registers with a court of law for the purpose of establishing the court’s jurisdiction over any disputes involving the trust?

No. In that case it would not be considered a reporting entity.

Does the activity or revenue of a company determine whether it is a

reporting company?

An entity’s activities and revenue, along with other factors in some cases, can potentially qualify it for an exemption. For example, there is an exemption for certain inactive

entities, and another for any company that reported more than $5 million in gross receipts or sales in the previous year and satisfies other exemption criteria. Neither

engaging solely in passive activities like holding rental properties, for example, nor being unprofitable necessarily exempts an entity from the BOI reporting requirements.

DISCLAIMER

Stanley Bronstein is a lawyer and a CPA, but he is not your lawyer or CPA unless and until he is hired by you as your lawyer and/or CPA. The information and opinions contained herein are just that, information and opinions intended to help you learn about and understand your filing requirements under the new Corporate Transparency Act. The information contained herein should not be considered to be the giving of legal advice or accounting advice, unless and until you hire Stanley Bronstein as your lawyer and/or CPA.

Copyright 2024 - Stanley F. Bronstein and fileCTApapers.com