HOW DO YOU REPORT THAT YOU'RE EXEMPT ?

A company does not need to report to FinCEN that it is exempt

from the BOI reporting requirements

if it has always been exempt.

If a company filed a BOI report and later qualifies for an exemption, that company should file an updated BOI report to indicate that it is newly exempt from the reporting requirements.

Updated BOI reports are filed electronically though the secure filing system.

An updated BOI report for a newly exempt entity will only require that the entity:

(1) identify itself; and

(2) check a box noting its newly exempt status.

TAX EXEMPT ENTITIES

What are the criteria for the tax-exempt entity exemption from the

beneficial ownership information reporting requirement?

An entity qualifies for the tax-exempt entity exemption if ANY of the following four criteria apply:

(1) The entity is an organization that is described in section 501(c) of the Internal Revenue Code of 1986 (Code) (determined without regard to section 508(a) of the Code) and exempt from tax under section 501(a) of the Code.

For HOAs and CONDO ASSNS, it depends on whether or not you've actually filed the paperwork with the IRS and received a determination letter from the IRS saying you've been granted tax exempt status. Here's an easy way to tell ...

If the HOA is filing an annual tax return on Form 990 or 990-EZ, that probably means it's been granted tax exempt status and doesn't need to file a beneficial ownership information report (but you should check to see if you have a determination letter in your file..

If the HOA is filing an annual tax return on Form 1120-H, that probably means it has NOT been granted tax exempt status and it DOES need to file a beneficial ownership information report.

(2) The entity is an organization that is described in section 501(c) of the Code, and was exempt from tax under section 501(a) of the Code, but lost its tax exempt status less than 180 days ago.

(3) The entity is a political organization, as defined in section 527(e)(1) of the Code, that is exempt from tax under section 527(a) of the Code.

(4) The entity is a trust described in paragraph (1) or (2) of section 4947(a) of the Code (primarily charitable trusts).

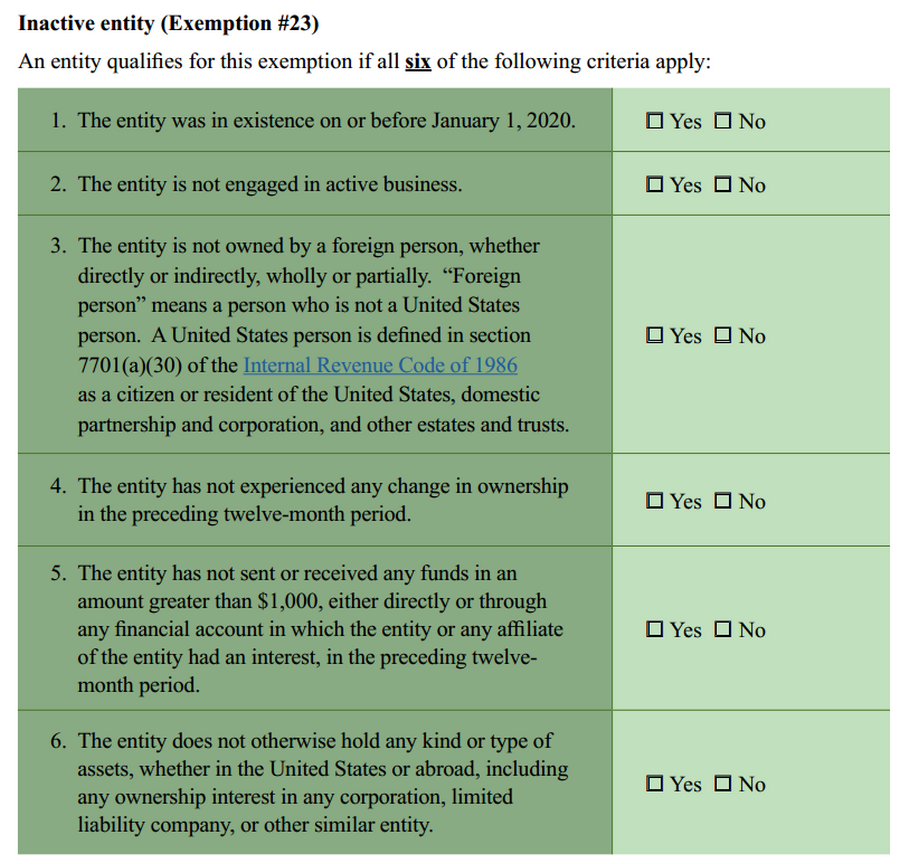

INACTIVE ENTITIES

What are the criteria for the inactive entity exemption from

the beneficial ownership information reporting requirement?

An entity qualifies for the inactive entity exemption if ALL SIX of the following criteria apply:

(1) The entity was in existence on or before January 1, 2020.

(2) The entity is not engaged in active business.

(3) The entity is not owned by a foreign person, whether directly or indirectly, wholly or partially. “Foreign person” means a person who is not a United States person. A United States person is defined in section 7701(a)(30) of the Internal Revenue Code of 1986 as a citizen or resident of the United States, domestic partnership and corporation, and other estates and trusts.

(4) The entity has not experienced any change in ownership in the preceding twelve-month period.

(5) The entity has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding twelve-month period.

(6) The entity does not otherwise hold any kind or type of assets, whether in the United States or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

RECOMMENDATION

If you're not sure whether your entity is exempt or not, go ahead and file.

You can't get in trouble for filing when you're not required,

but you can definitely get in trouble for not filing.

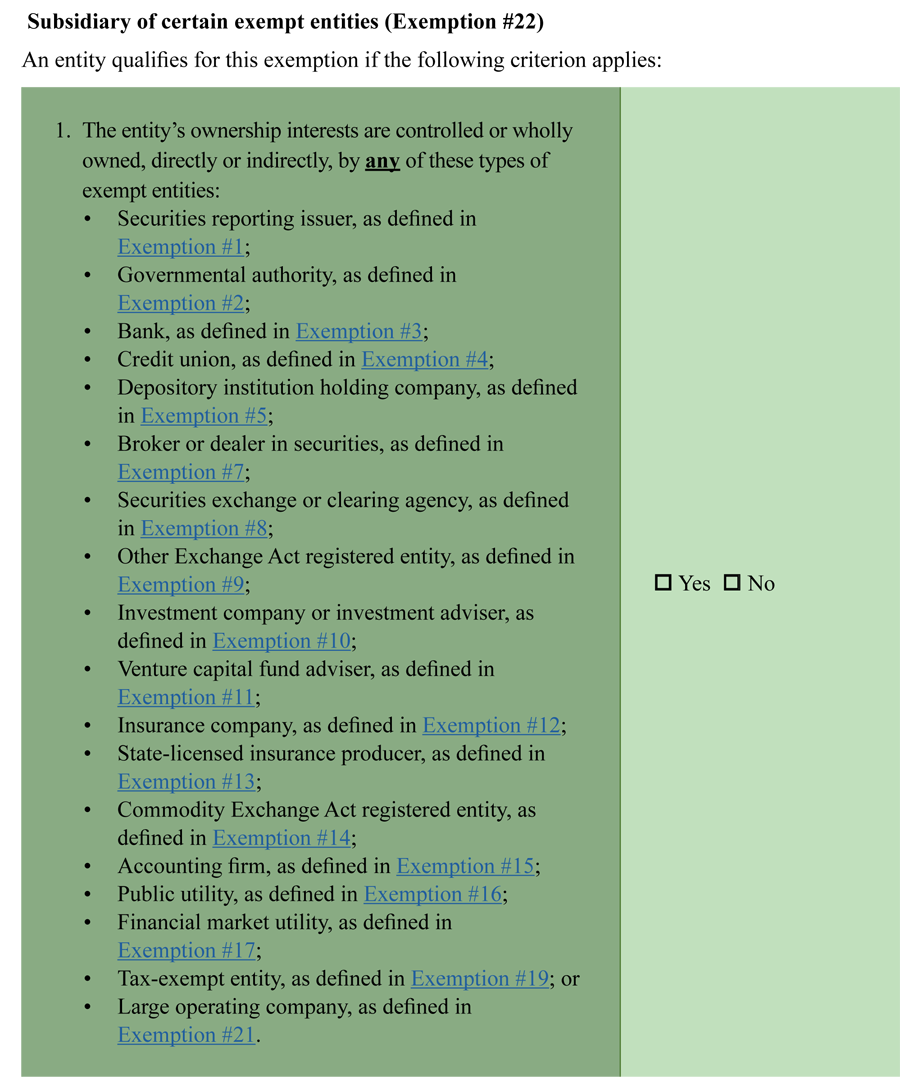

SUBSIDIARY EXEMPTIONS

What are the criteria for the subsidiary exemption

from the beneficial ownership information reporting requirement?

Subsidiaries of certain types of entities that are exempt from the beneficial ownership information reporting requirements may also be exempt from the reporting requirement.

An entity qualifies for the subsidiary exemption if the entity’s ownership interests

are controlled or wholly owned, directly or indirectly, by ANY of these types of exempt entities:

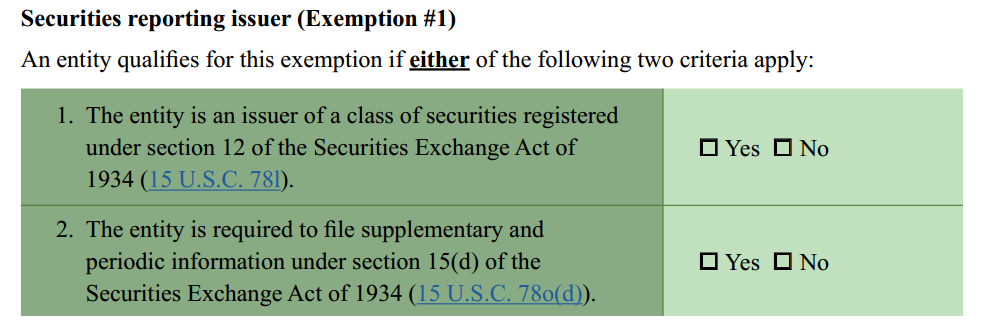

Securities reporting issuer;

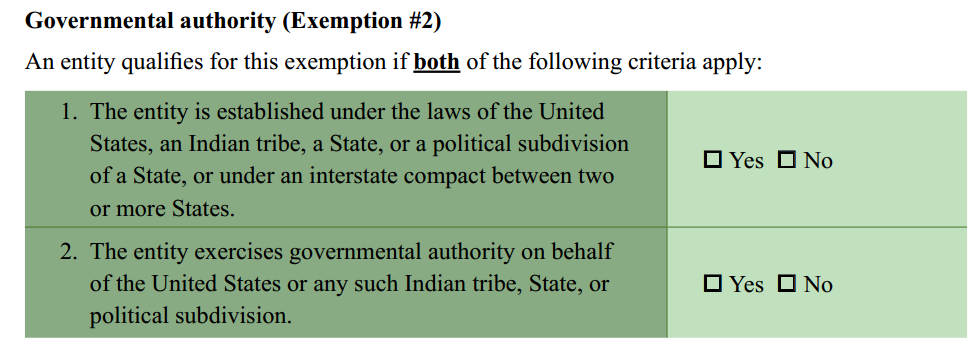

Governmental authority;

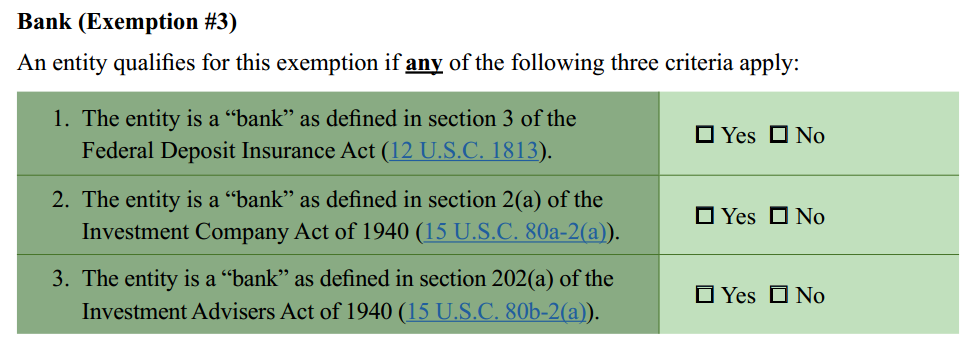

Bank;

Credit union;

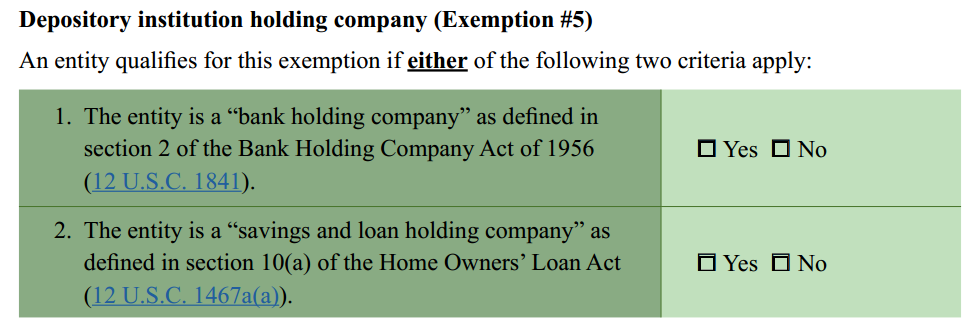

Depository institution holding company;

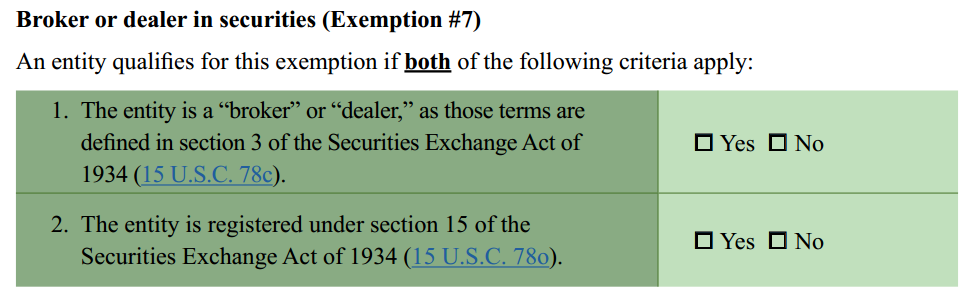

Broker or dealer in securities;

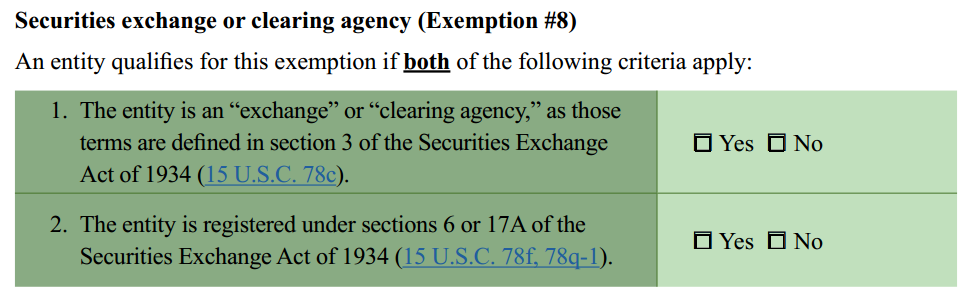

Securities exchange or clearing agency;

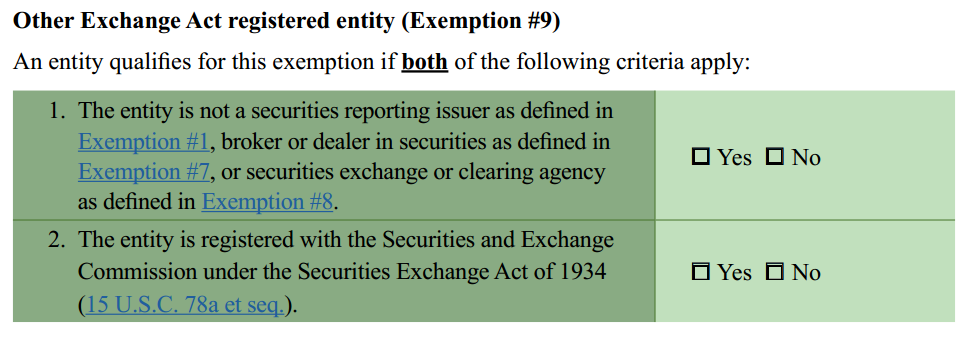

Other Exchange Act registered entity;

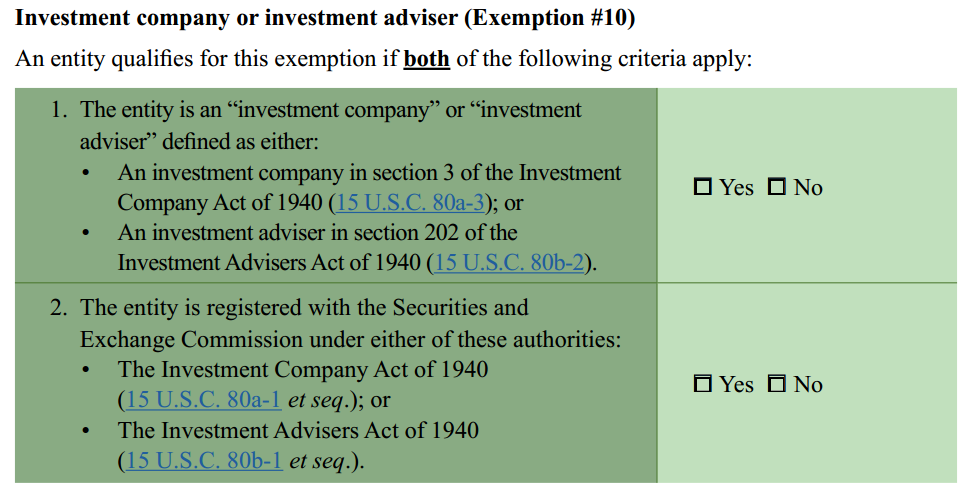

Investment company or investment adviser;

Venture capital fund adviser;

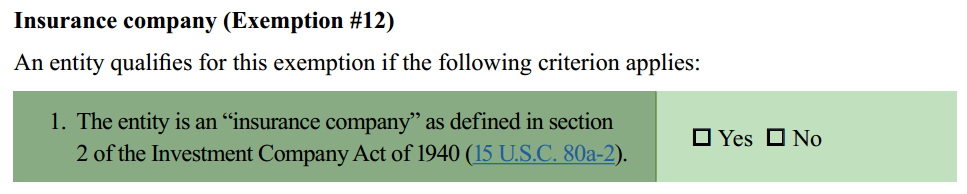

Insurance company;

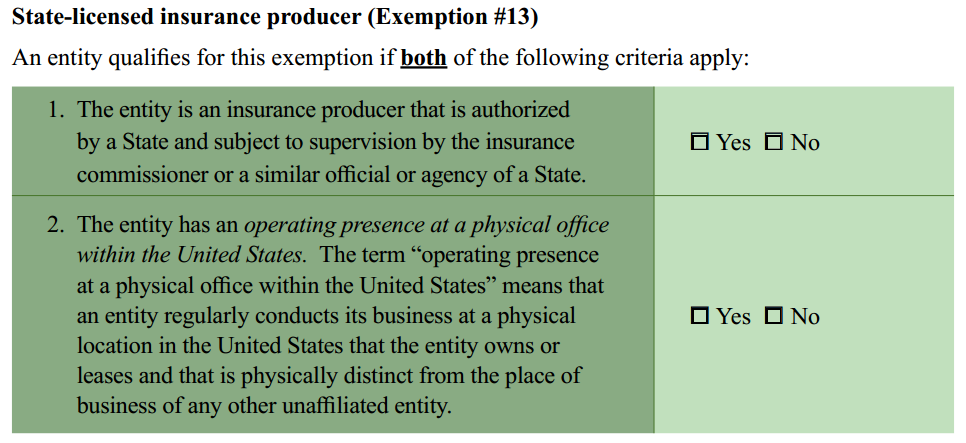

State-licensed insurance producer;

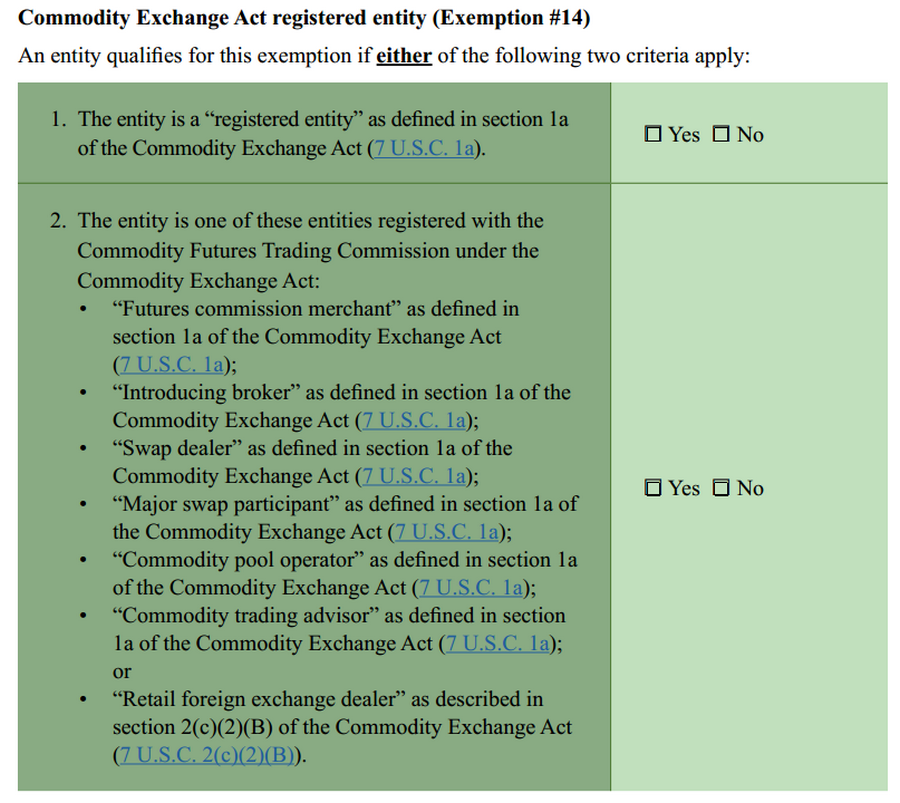

Commodity Exchange Act registered entity;

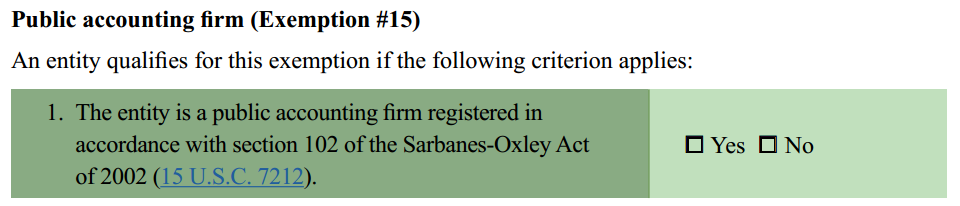

Accounting firm (if already registered under Sarbanes Oxley);

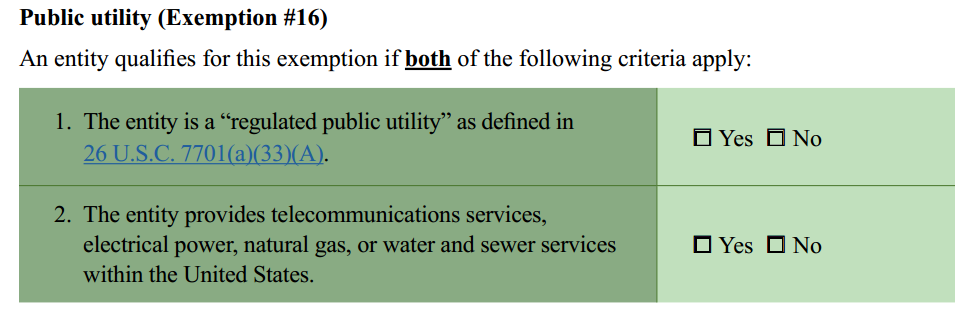

Public utility;

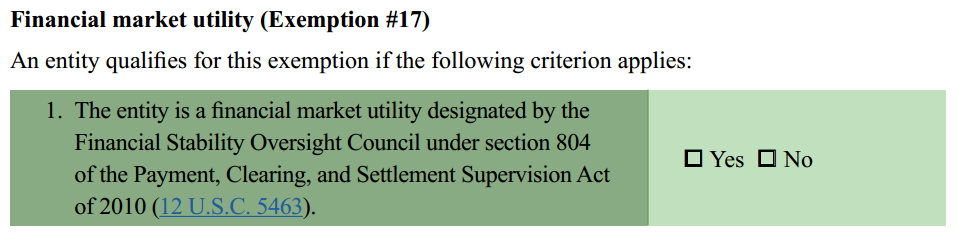

Financial market utility;

Tax-exempt entity; or

Large operating company.

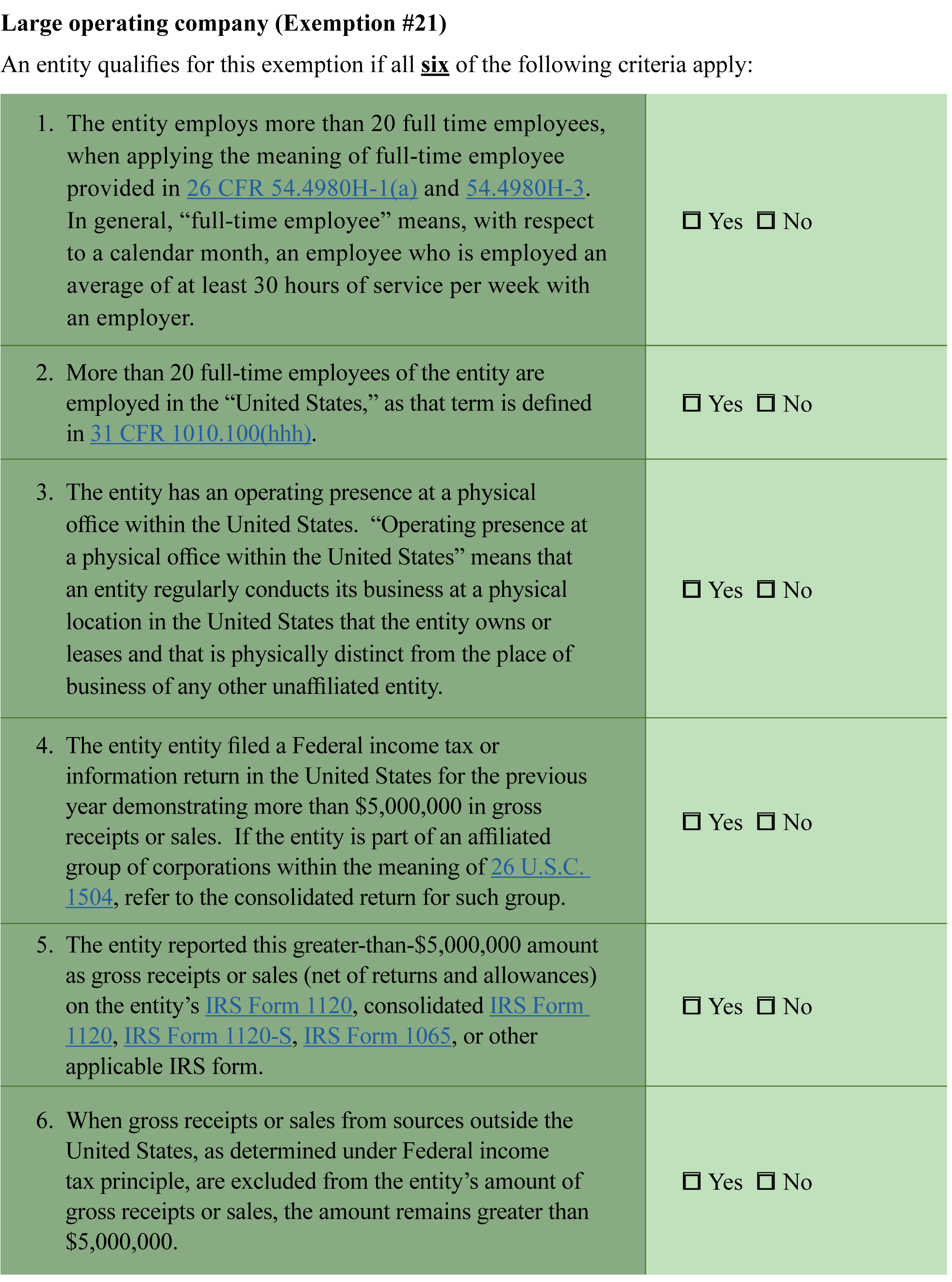

RELATED COMPANIES

If I own a group of related companies, can you consolidate

employees across those companies to meet the criteria

of a large operating company exemption

from the reporting company definition?

No. The large operating company exemption requires that the entity itself employ more than 20 full-time employees in the United States and does not permit consolidation of this employee count across multiple entities.

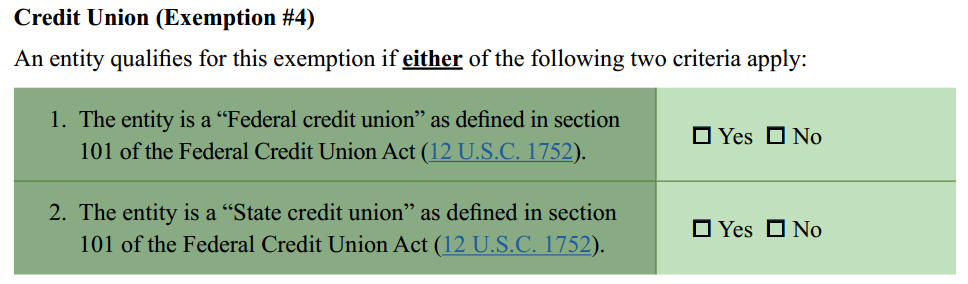

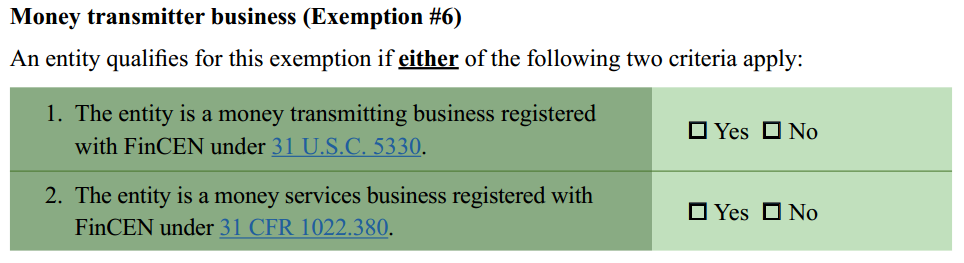

THE 23 TYPES OF EXEMPTIONS

MOST OF THESE WILL NOT APPLY TO YOUR COMPANY

AND A FEW ARE DISCUSSED ABOVE IN MORE DETAIL

DISCLAIMER

Stanley Bronstein is a lawyer and a CPA, but he is not your lawyer or CPA unless and until he is hired by you as your lawyer and/or CPA. The information and opinions contained herein are just that, information and opinions intended to help you learn about and understand your filing requirements under the new Corporate Transparency Act. The information contained herein should not be considered to be the giving of legal advice or accounting advice, unless and until you hire Stanley Bronstein as your lawyer and/or CPA.

Copyright 2024 - Stanley F. Bronstein and fileCTApapers.com