WHO IS A COMPANY APPLICANT

AND MUST THEY BE REPORTED?

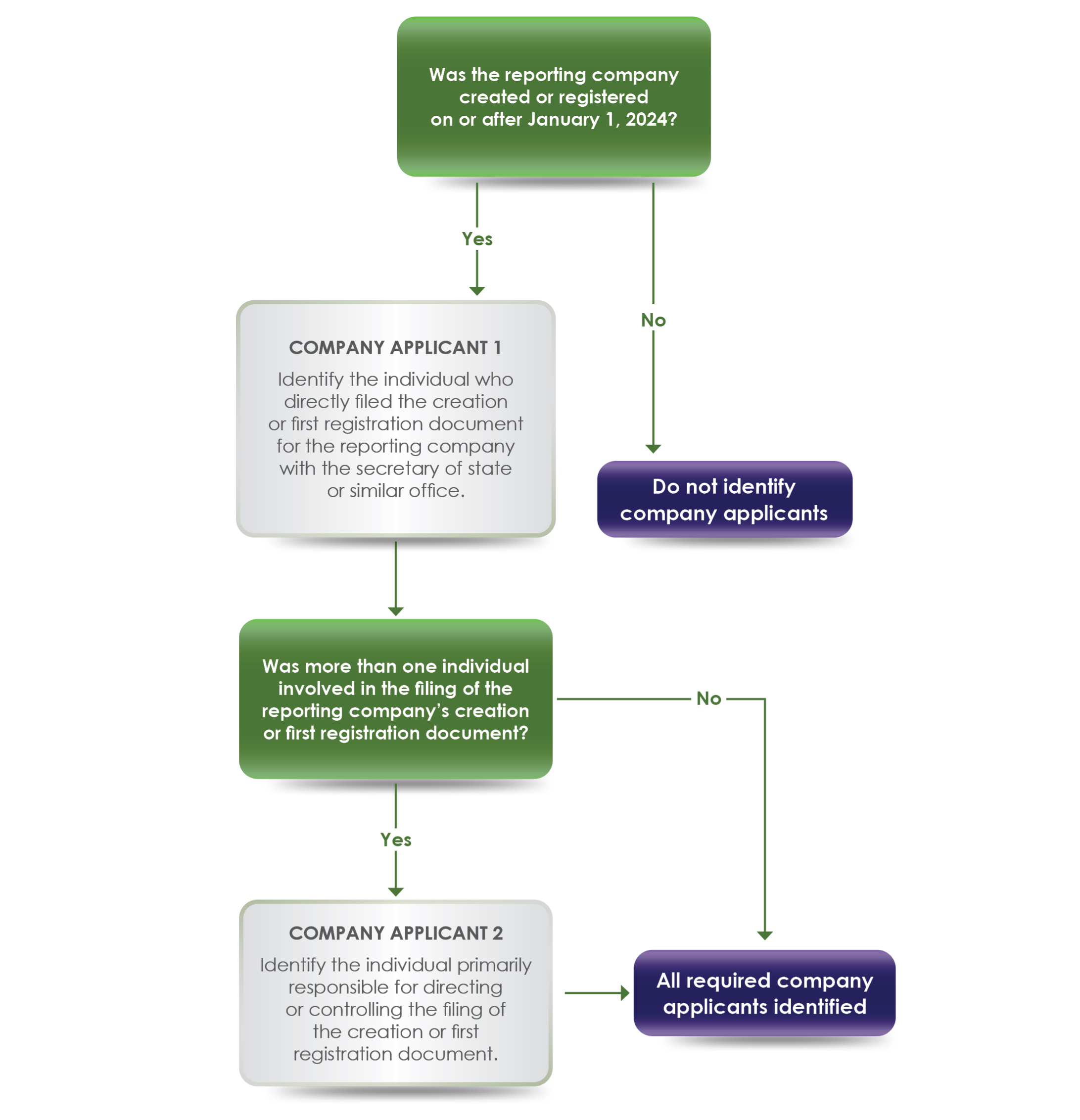

A company that must report its company applicants will have only up to two individuals who could qualify as company applicants:

The individual who directly files the document that creates or registers the company; and

If more than one person is involved in the filing, the individual who is primarily responsible for directing or controlling the filing.

Only reporting companies created or registered on or after January 1, 2024, will need to report their company applicants.

... BE SURE TO KEEP READING BELOW FOR MORE INFO .....

HERE'S A USEFUL CHART TO HELP FIGURE THIS OUT

..... BUT BE SURE TO KEEP READING BELOW FOR MORE INFO .....

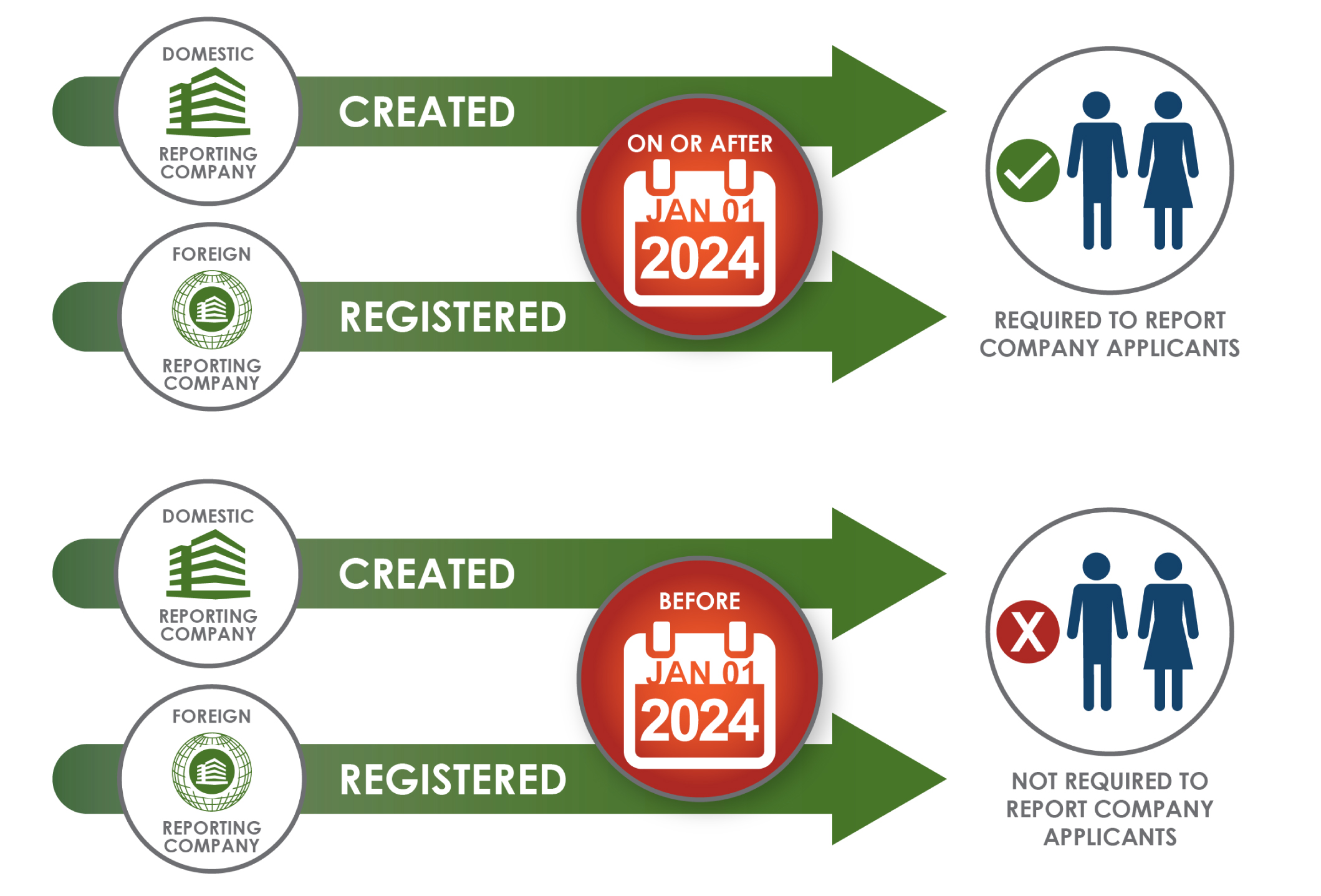

Not all reporting companies have to report their company applicants to FinCEN.

A reporting company must report its company applicants only if it is either a:

Domestic reporting company created in the United States on or after January 1, 2024 ; or

Foreign reporting company first registered to do business in the United States on or after January 1, 2024.

A reporting company does NOT have to report its company applicants if it is either a:

Domestic reporting company created in the United States before January 1, 2024; or

Foreign reporting company first registered to do business in the United States before January 1, 2024.

Is my accountant or lawyer considered a company applicant?

An accountant or lawyer could be a company applicant, depending on their role in filing the document that creates or registers a reporting company. In many cases, company applicants may work for a business formation service or law firm.

An accountant or lawyer may be a company applicant if they directly filed the document that created or registered the reporting company. If more than one person is involved in the filing of the creation or registration document, an accountant or lawyer may be a company applicant if they are primarily responsible for directing or controlling the filing.

For example, an attorney at a law firm that offers business formation services may be primarily responsible for overseeing preparation and filing of a reporting company’s incorporation documents. A paralegal at the law firm may directly file the incorporation documents at the attorney’s request. Under those circumstances, the attorney and the paralegal are both company applicants for the reporting company.

Can a company applicant be removed from a BOI report if the company applicant no longer has a relationship with the reporting company?

No. A company applicant may not be removed from a BOI report even if the company applicant no longer has a relationship with the reporting company. A reporting company created on or after January 1, 2024, is required to report company applicant information in its initial BOI report, but is not required to file an updated BOI report if information about a company applicant changes.

DISCLAIMER

Stanley Bronstein is a lawyer and a CPA, but he is not your lawyer or CPA unless and until he is hired by you as your lawyer and/or CPA. The information and opinions contained herein are just that, information and opinions intended to help you learn about and understand your filing requirements under the new Corporate Transparency Act. The information contained herein should not be considered to be the giving of legal advice or accounting advice, unless and until you hire Stanley Bronstein as your lawyer and/or CPA.

Copyright 2024 - Stanley F. Bronstein and fileCTApapers.com