WHO IS A BENEFICIAL OWNER

OF A REPORTING COMPANY ?

A BENEFICIAL OWNER is an individual who either directly or indirectly: (1) exercises

substantial control over the reporting company, or (2) owns or controls at least 25% of the reporting company’s ownership interests

..... SCROLL DOWN FOR MORE INFO .....

WHAT IS SUBSTANTIAL CONTROL ?

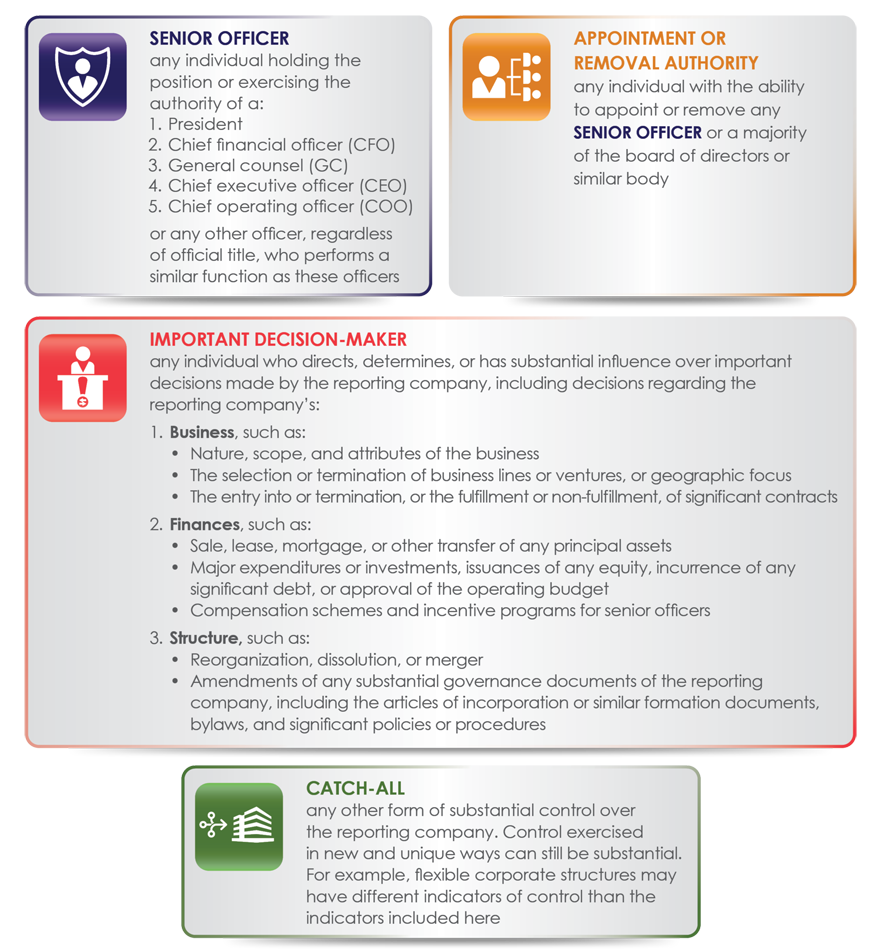

SUBSTANTIAL CONTROL - An individual can exercise substantial control over a reporting company in four different ways. If the individual falls into any of the categories below, the individual is exercising substantial control:

-----

• The individual is a senior officer (the company’s president, chief financial officer, general counsel, chief executive office, chief operating officer, or any other officer who performs a similar function).

• The individual has authority to appoint or remove certain officers or a majority of directors (or similar body) of the reporting company.

• The individual is an important decision-maker for the reporting company.

• The individual has any other form of substantial control over the reporting company

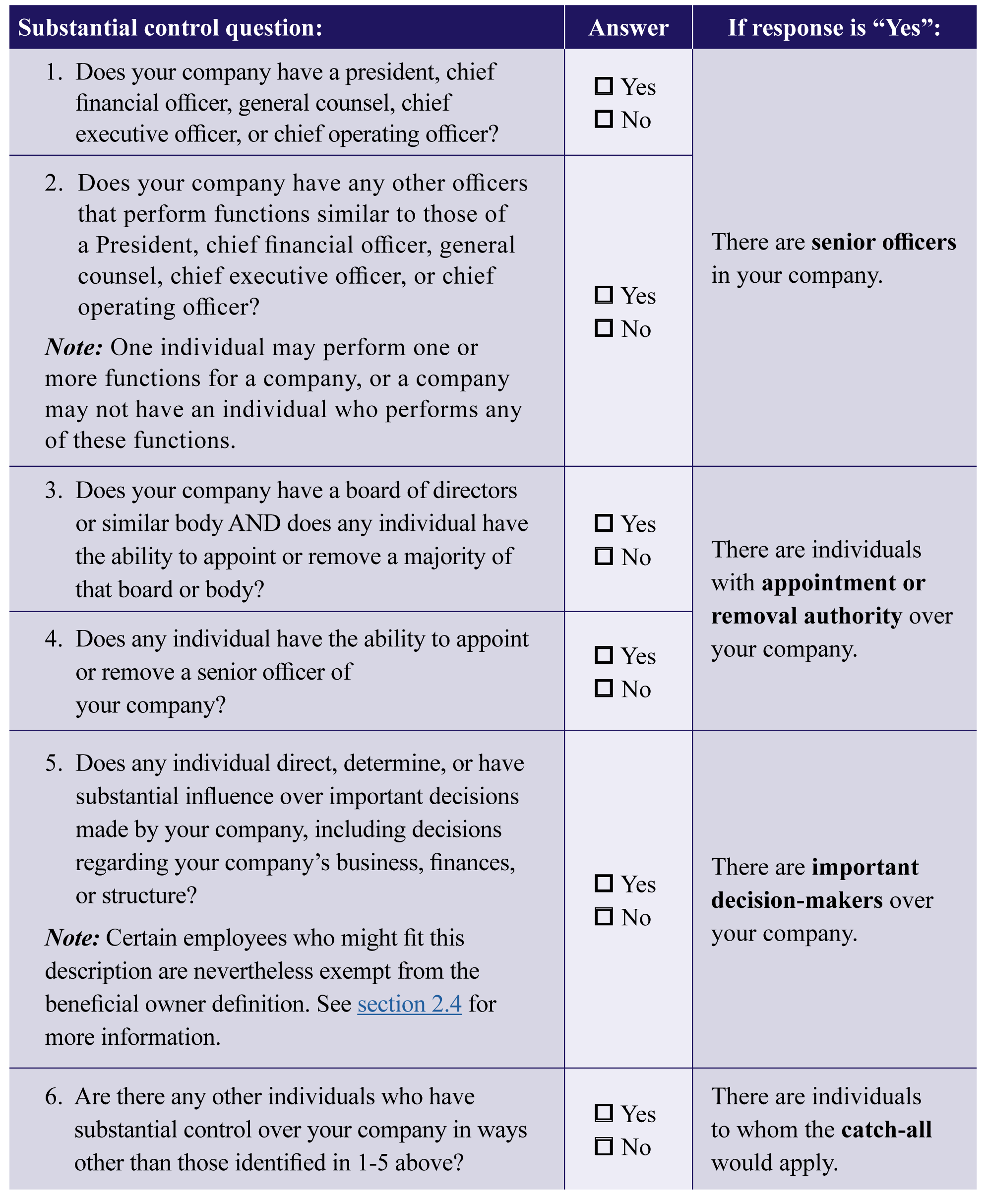

HERE'S A USEFUL CHART TO HELP FIGURE THIS OUT

... BUT BE SURE TO KEEP READING BELOW FOR MORE INFO .....

HERE'S A LIST OF QUESTIONS TO HELP YOU DETERMINE WHO HAS SUBSTANTIAL CONTROL

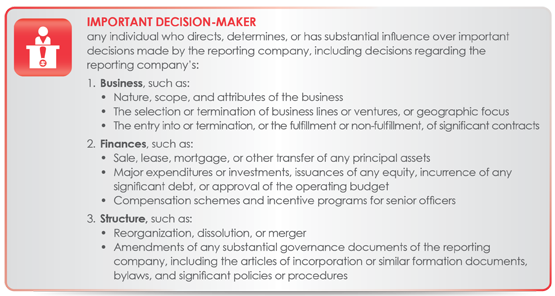

One of the indicators of substantial control is that the individual is an important decision-maker. What are important decisions?

Important decisions include decisions about a reporting company’s business, finances, and structure. An individual that directs, determines, or has substantial influence over these important decisions exercises substantial control over a reporting company.

What is an ownership interest?

An ownership interest is generally an arrangement that establishes ownership rights in the reporting company. Examples of ownership interests include shares of equity, stock, voting rights, or any other mechanism used to establish ownership.

Is my accountant or lawyer considered a beneficial owner?

Accountants and lawyers generally do not qualify as beneficial owners, but that may depend on the work being performed. Accountants and lawyers who provide general accounting or legal services are not considered beneficial owners because ordinary, arms-length advisory or other

third-party professional services to a reporting company are not considered to be “substantial control”. In addition, a lawyer or accountant who is designated as an agent of the reporting company may qualify for the “nominee, intermediary, custodian, or agent” exception from the beneficial owner definition. However, an individual who holds the position of general counsel in a reporting company is a “senior officer” of that company and is therefore a beneficial owner.

Is a member of a reporting company’s board of directors always a beneficial owner of the reporting company?

No. A beneficial owner of a company is any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.

Whether a particular director meets any of these criteria is a question that the reporting company must consider on a director-by-director basis.

Is an unaffiliated company that provides a service to the reporting company by managing its day-to-day operations, but does not make decisions on important matters, a beneficial owner of the reporting company?

The unaffiliated company itself cannot be a beneficial owner of the reporting company because a beneficial owner must be an individual. Any individuals that exercise substantial control over the reporting company through the unaffiliated company must be reported as beneficial owners of the reporting company.

However, individuals who do not direct, determine, or have substantial influence over important decisions made by the reporting company, and do not otherwise exercise substantial control, may not be beneficial owners of the reporting company. (This can be tricky area for some companies, as it may not be 100% clear if an individual should be reported or not. In those situations, we recommend you file anyway, as a precaution. REMEMBER - You can't get in trouble for filing if you weren't required, BUT you can get into massive trouble if you don't file when you were required to)

Is a reporting company’s designated “partnership representative” or “tax

matters partner” a beneficial owner?

It depends. A reporting company’s “partnership representative,” as defined in the IRS tax code, or “tax matters partner,” as the term was previously defined in a now-repealed section of the IRS tax code, is not automatically a beneficial owner of the reporting company. However, such an individual may qualify as a beneficial owner of the reporting company if the individual exercises substantial control over the reporting company, or owns or controls at least 25 percent of the company’s ownership interests.

What information should a reporting company report about a beneficial

owner who holds their ownership interests in the reporting company through multiple exempt entities?

If a beneficial owner owns or controls their ownership interests in a reporting company exclusively through multiple exempt entities, then the names of all of those exempt entities may be reported to FinCEN instead of the individual beneficial owner’s information.

Note that this special rule does not apply when an individual owns or controls ownership interests in a reporting company through both exempt and non-exempt entities. In that case, the reporting company must report the individual as a

beneficial owner (if no exception applies), but the exempt companies do not need to be listed.

Who qualifies for an exception

from the beneficial owner definition?

There are five instances in which an individual who would otherwise be a beneficial owner of a reporting company qualifies for an exception. In those cases, the reporting company does not have to report that individual as a beneficial owner to FinCEN.

EXCEPTION #1 - MINOR CHILD

The individual is a minor child, as defined under the law of the State or Indian tribe in which the domestic reporting company is created or the foreign reporting company is first registered.

NOTE: This exception only applies if a parent or legal guardian’s information is reported in lieu of the minor child’s information. Also, when the minor child reaches the age of majority, as defined by the law of the State or Indian tribe in which the reporting company was created or first registered, the exception no longer applies. At that time, if the individual is a beneficial owner, the reporting company must file an updated BOI report providing the individual’s own information.

EXCEPTION #2 - NOMINEE, INTERMEDIARY, CUSTODIAN OR AGENT

An individual qualifies for this exception if the individual merely acts on behalf of an actual beneficial owner as the beneficial owner’s nominee, intermediary, custodian, OR agent.

Note: Individuals who perform ordinary advisory or other contractual services (such as tax professionals) likely qualify for this exception. In scenarios where this exception applies, the actual beneficial owner must still be reported.

EXCEPTION #3 - EMPLOYEE

An individual qualifies for this exception if ALL THREE of the following criteria apply:

- 1. The individual is an employee of the reporting company. In general, the term employee means that

an individual is subject to the will and control of the employer in what and how to do work, and that the employer may discharge the individual from work. - 2. The individual’s substantial control over, or economic benefits from, the reporting company are derived solely from the employment status of the individual as an employee.

- 3. The individual is not a senior officer of the reporting company. If they are a senior officer, they must be reported.

EXCEPTION #4 - INHERITOR

An individual qualifies for this exception if the individual’s only interest in the reporting company is a future interest through a right of inheritance, such as through a will providing a future interest in a company.

Note: Once the individual inherits the interest, this exception no longer applies, and the individual may qualify as a beneficial owner.

EXCEPTION #5 - CREDITOR

An individual qualifies for this exception if the individual is a creditor of the reporting company.

The term “creditor” means an individual who would meet the

definition of a beneficial owner of the reporting company solely through rights or interests for the payment of a predetermined sum of money, such as a debt incurred by the reporting company, or a loan covenant or other similar right associated with such right to receive payment that is intended to secure the right to receive payment or enhance the likelihood of repayment.

For example, an individual qualifies for the creditor exception if the individual is entitled to payment from the reporting company to satisfy a loan or debt, so long as this entitlement is the only ownership interest the individual has in the reporting company.

DISCLAIMER

Stanley Bronstein is a lawyer and a CPA, but he is not your lawyer or CPA unless and until he is hired by you as your lawyer and/or CPA. The information and opinions contained herein are just that, information and opinions intended to help you learn about and understand your filing requirements under the new Corporate Transparency Act. The information contained herein should not be considered to be the giving of legal advice or accounting advice, unless and until you hire Stanley Bronstein as your lawyer and/or CPA.

Copyright 2024 - Stanley F. Bronstein and fileCTApapers.com